AMFI-registered Mutual Fund Distributor

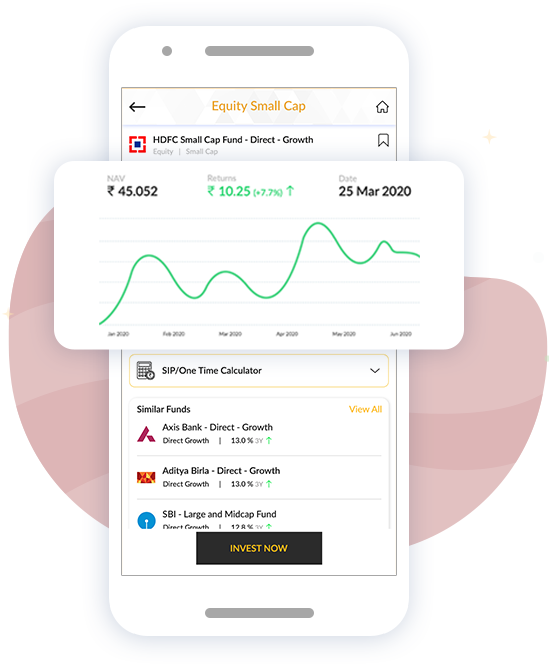

Invest Through Mutual Funds

Smart & Secure Investments to achieve your Financial Goals

NDSL Payments Bank brings you Mutual Funds

investments solutions from leading fund houses

-

Track, analyse, and manage your portfolio effortlessly

- Client login -

Empower your business as a Sub-broker

Advanced investment management tools for your business.

- Subbroker login